Problem

Unavailability of reconciled airline/hotel invoices resulting in Loss/Delay in GST Credit and thereby Cash flows

Solution Offered

An RPA tool to automate travel expense booking and GST credit

How it works?

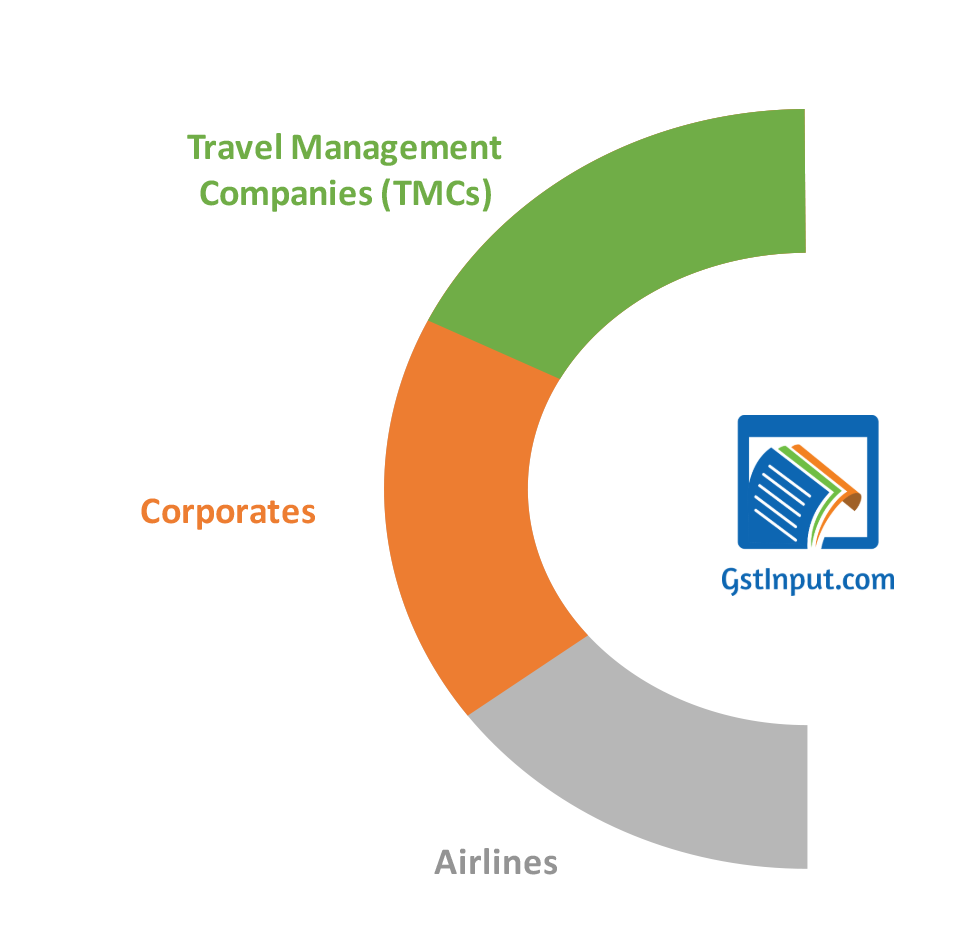

GSTInput helps companies to claim the right amount of GST credit for their airline or hotel travel expenses. The product helps to reconcile data received from the Travel Management Companies, the GSTR data and the Invoices from airlines/hotels. When a customer books an air ticket or a hotel accommodation with their travel agent, the travel agent provides the needed booking confirmation details after the tickets are booked with the Airline carrier or with the Hotel. The Airline or Hotel in turn generate an invoice and share with the customer, they also book the same in their GST returns. Such an involvement of multiple parties often makes claiming GST credits and retrieving invoices a difficult process. Here is where GSTInput intervenes and helps the customer by providing them the reconciled data at the correct time. For more details, please watch the videos below:

Why Us?

Network Effects due to Our Connected Platform

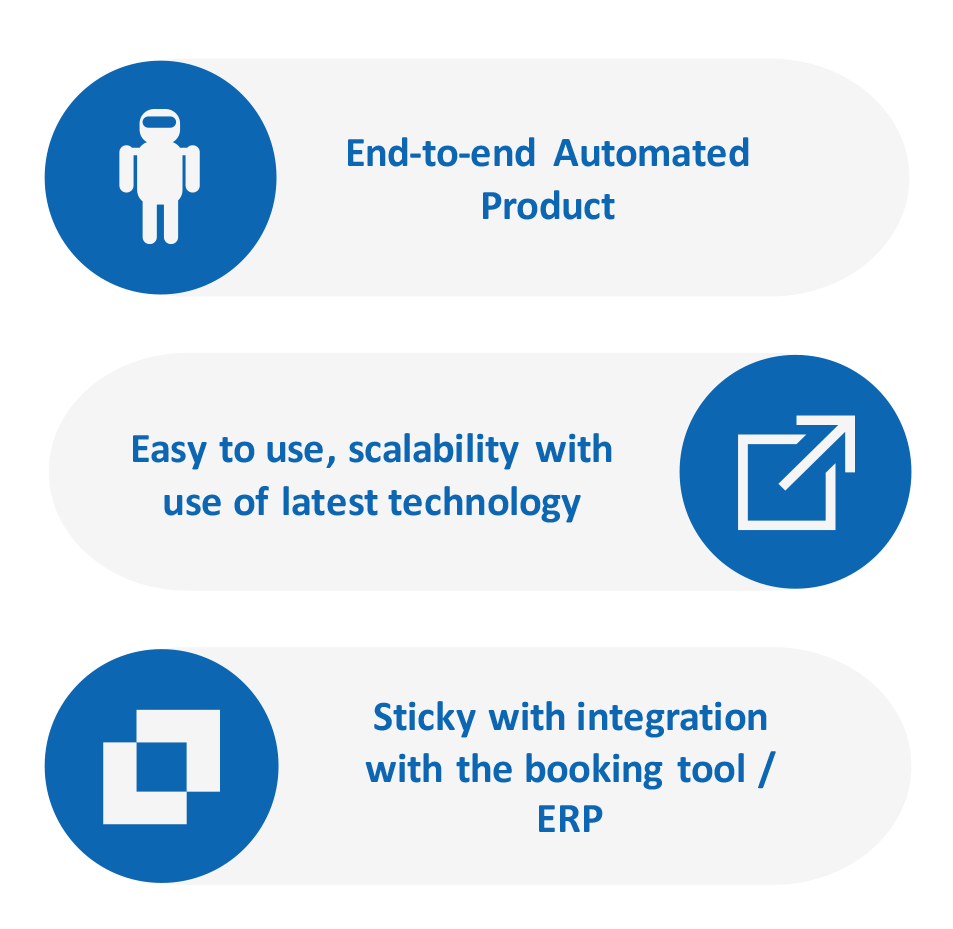

Key Differentiating Factors

Invoice retrieved

Booking transactions

GST amount

Total transaction amount

Our Clients